[ad_1]

- As investors fear the ongoing impacts of the coronavirus outbreak, and with the bull market stretching on, Citi said gold looks set to outperform.

- The firm’s analysts, led by Aakash Doshi, forecast gold topping $2,000 per ounce in the next 12 to 24 months.

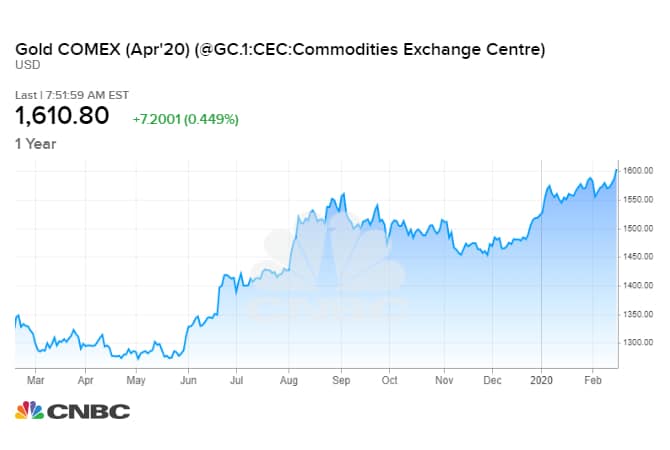

- On Tuesday, gold settled above $1,600 per ounce for the first time since 2013.

As the record bull market stretches on, and as the coronavirus outbreak incites fears of a potential slowdown in global growth, gold could be a way for investors to hedge risks to the downside, Citi said Wednesday.

The firm believes market jitters will prompt investors to pile into the so-called safe haven asset, pushing gold prices to $2,000 per ounce in the next 12 to 24 months.

“Gold should perform as a convex macro asset market hedge, resilient during ongoing risk market rallies but a better hedge during sell-offs and vol spikes,” the analysts led by Aakash Doshi said.

On Tuesday, gold settled above the $1,600 mark for the first time since April 2013, as investors reacted to Apple’s announcement that it would miss quarterly revenue forecasts thanks to constrained worldwide supply of iPhones, as well as lower Chinese demand stemming from the virus outbreak.

Shorter-term, Citi lifted its six-to-12 month target on gold to $1,700 per ounce.

Doshi said that the bullish activity in gold this year indicates growing investor concern over where we are in the business cycle, as well as ongoing uncertainties surrounding the U.S.-China trade war and the upcoming U.S. election.

He said that the economic backdrop is also supportive for gold since it tends to do well in a low interest rate environment as investors look for yield.

“With STIR [short-term interest rate] markets pricing in ~1.5 Fed cuts in 2020 and global growth risks skewed to the downside, gold is a direct beneficiary of the low nominal and negative real yield environment,” Doshi said, while adding that gold can also “outperform on a risk market unwind should coronavirus risks impact supply chains and thus US earnings momentum.”

Subscribe to CNBC PRO for exclusive insights and analysis, and live business day programming from around the world.

– CNBC’s Michael Bloom contributed reporting.

[ad_2]