[ad_1]

With the S&P 500 close to a record-high you might wisely be thinking more about portfolio diversification. Portfolio diversification can help smooth out volatility. Further, you may be able to find investments that zig when your stocks zag.

Diversifying through bonds is the most common way to gain portfolio diversification. However, with the 10-year bond yield under 1% and the Fed Funds rate at 0% – 0.25%, bond performance seems limited. Another growing way to diversify is through alternative investments.

An alternative investment is an investment in any asset class excluding stocks, bonds, and cash. Alternative investments include tangible assets such as precious metals, art, wine, antiques, coins, or stamps and some financial assets such as real estate, commodities, private equity, distressed securities, hedge funds, venture capital, film production and more.

This is a joint sponsored post by FarmTogether, Masterworks, and Vinovest. They’ve helped keep the lights on all year here at Financial Samurai.

Benefits Of Alternative Investments

We recently learned that the $31 billion Yale endowment fund has ~65% of its assets in alternative investments. Meanwhile, just 2.25% of its assets are in domestic equities. Therefore, it’s worth exploring alternative investments even further.

Preqin, a leading industry data provider, believes AUM is on track to reach $14 trillion by 2023 (from $10 trillion in 2019. In a survey by Nataxis, 71% of institutional investors said that the potential for higher returns offered by alternative investments makes them worth the reduced liquidity.

Alternatives have several benefits. They increase your portfolio’s diversification, as their performance is uncorrelated with the performance of the stock market.

Alternative investments are also beneficial because they tend to be less volatile than publicly traded assets. Reducing overall portfolio volatility enables investors to sleep better at night, especially investors with a heftier amount of assets.

A study by TIAA and the National Association of College and University Business Officers found that venture capital and private equity were the top two performing asset classes among college and university endowments in 2019. They beat out U.S. equities’ returns by two to five percentage points.

Let’s explore investing in fine art, farmland, and fine wine.

For Fine Art Investing: Masterworks

Fine art is one of the more well-known alternative investments, particularly for ultra-high net worth individuals.

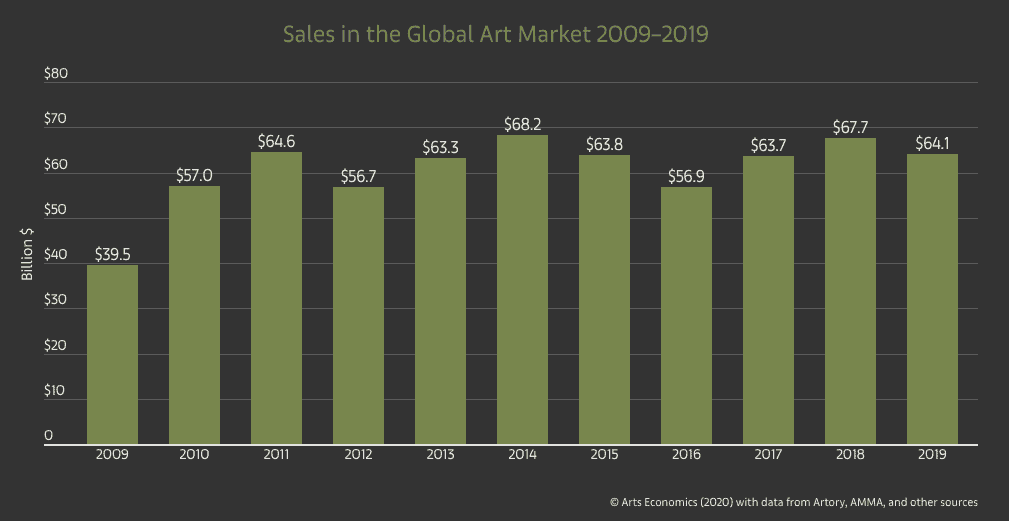

The global art market is valued around $1.7 trillion, with roughly $64.1 billion in sales in 2019. As can be seen from the chart below, this is up from $39.5 billion in sales in 2009, which translates to a 10-year CAGR of 5.0%.

Like gold, fine art is a real asset that is considered a long-term store of value. Fine art is uncorrelated with the performance of the stock market and other major asset classes. Therefore, fine art is a good candidate for diversifying a portfolio.

Deloitte found that the quest for diversification was a motivating factor for 52% of collectors in 2019, up from only 36% in 2017.

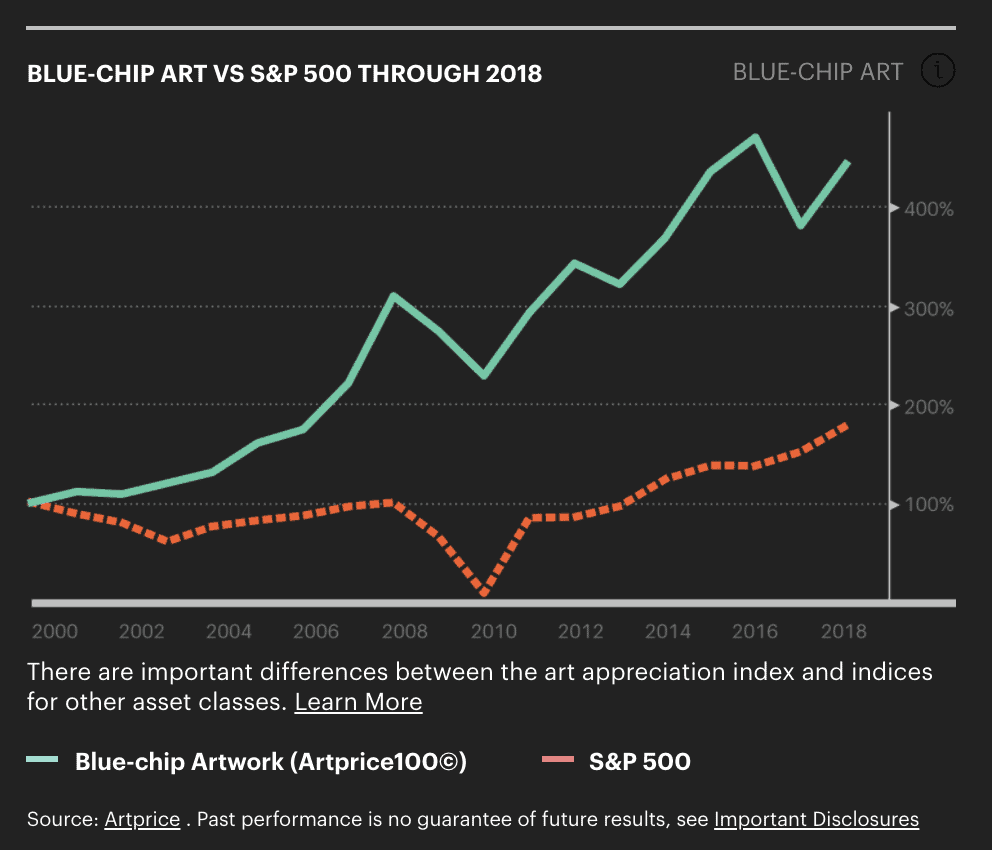

Fine art can also deliver attractive long-term returns. The Artprice100 index, which tracks the performance of 100 “blue chip” artists, delivered average annual returns of 8.9% between 2008 and 2018 and out-performed the S&P 500 by over 250%.

In the past, fine art investing was something that only mega-rich investors could do, since there were next-to-no financial operations that could turn fine art pieces into a shared portfolio asset. You either owned a piece of art, or you didn’t. Masterworks has changed that.

With Masterworks, investors can participate in a community that jointly holds a stake in valuable artwork.

You can buy and sell shares that represent an investment in iconic works of art from world-renowned artists like Banksy, Basquiat and KAWS, all without having to become an expert with a keen eye for auction opportunities. You can sign up for Masterworks here.

For Farmland Investing: FarmTogether

Real estate is a go-to alternative investment type for those who want to incorporate steady appreciation into a diverse portfolio. Picking the right kind of real estate investment typically meant buying properties on your own or buying shares in a real estate investment trust. However farmland real estate is a special alternative investment for further portfolio diversification.

Farmland is a relatively new asset class for most investors, given high barriers to entry. Further, farmland has historically been family owned. However, farmland has many attractive characteristics that make it worth considering.

Farmland is a real asset with intrinsic value underpinned by one of our most basic needs: the need to eat. It is uncorrelated with other major asset classes and less volatile than stocks and traditional real estate.

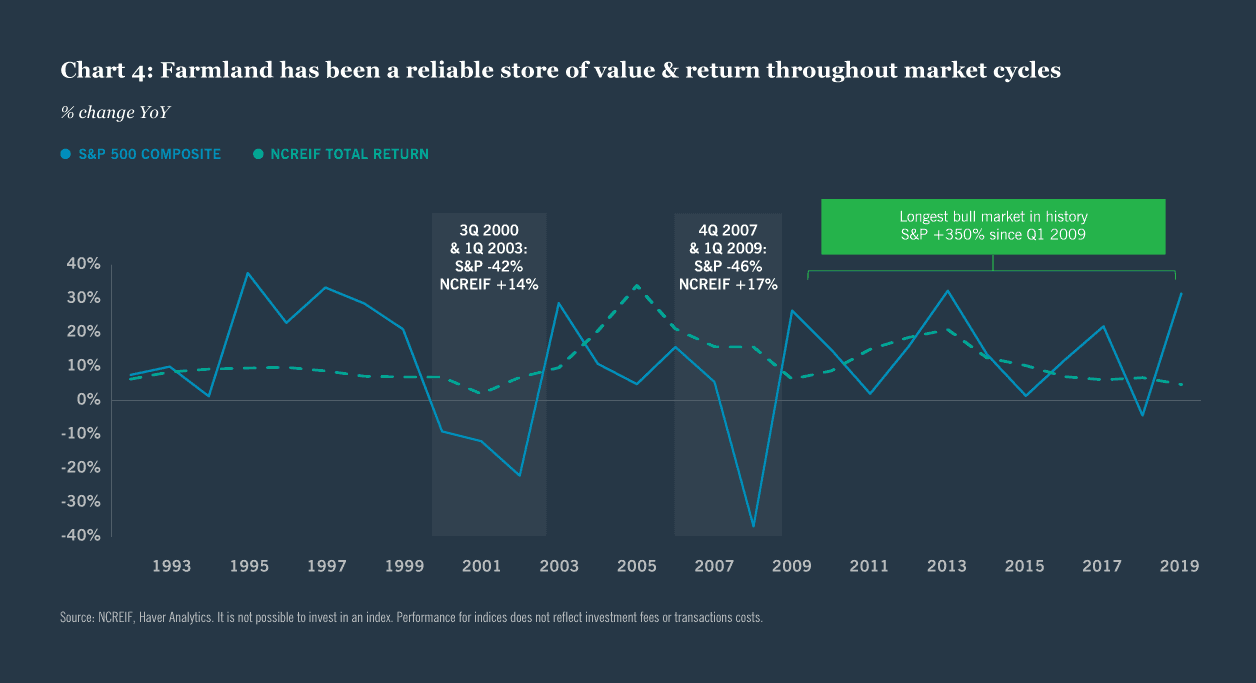

Farmland has also offered average annual returns of ~10% since 1992, including periodic crop and lease payments and price appreciation. Finally, farmland performs well throughout the economic cycle. For example, during the Great Financial Crisis (GFC), the NCREIF farmland index was up nearly 20%.

FarmTogether is designed to blend the best of several real estate investment options. With FarmTogether, investors can put money into hand-selected farmland opportunities across the country. Members get upfront information about the anticipated return on their investment, average cash yield figures, and the expected return on the sale of a farm.

FarmTogether offers investors a detailed dashboard that makes it simple to keep an eye on their investments within the platform. FarmTogether demystifies the process of keeping tabs on performance.

Plus, the platform offers guidance and support from a dedicated team of investors who understand the ins and outs of the market. You can sign up here for free.

For Fine Wine Investing: Vinovest

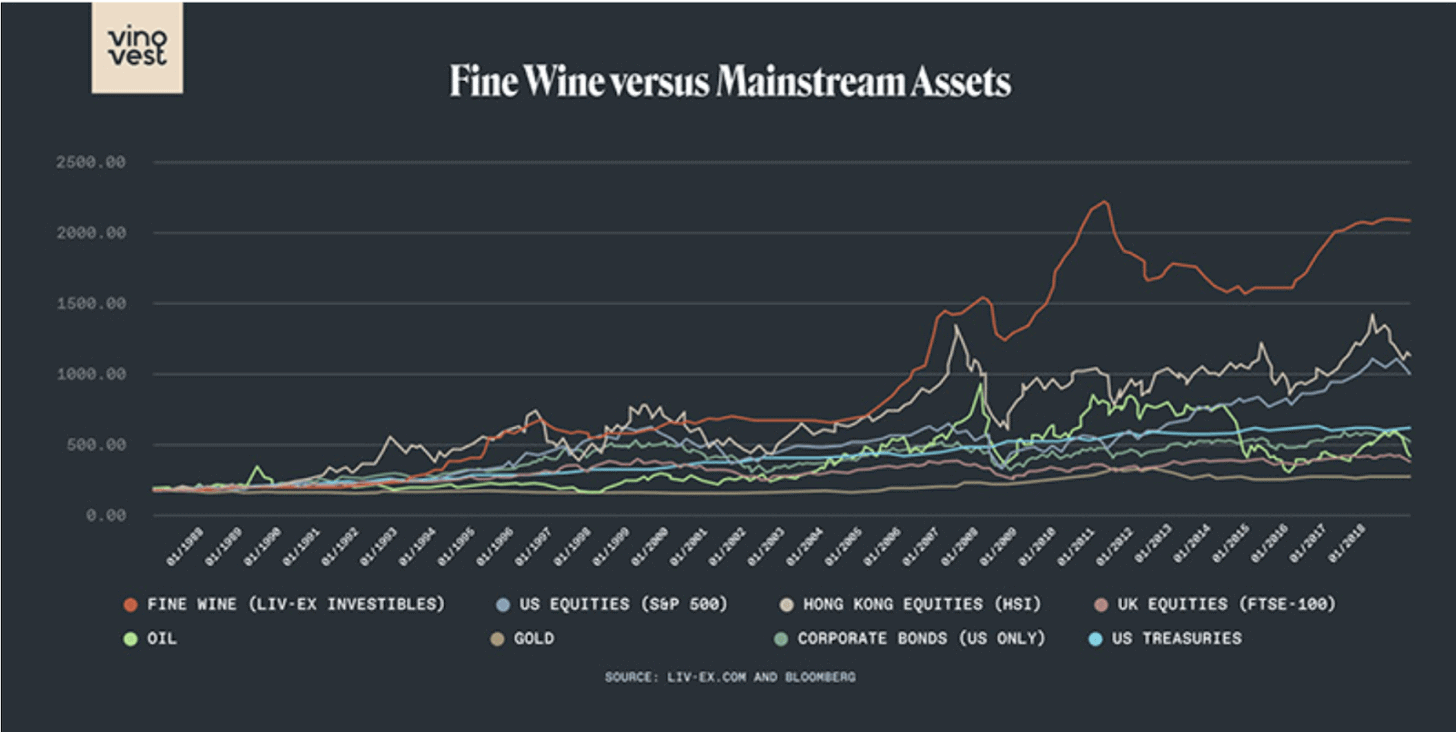

The world of fine wine includes a robust market for some of the rarest vintages on earth, which command hefty price tags as well. In fact, the fine wine market has outpaced the S&P 500 over the past three decades, with 11.6% annualized returns.

Whether you’re an aspirational sommelier or an investor who’s interested in finding new ways to diversify, investing in fine wine with Vinovest can give you a unique asset with a modern twist.

In the past, fine wine investors had to go through the process of selecting which wines they wanted in their portfolio largely on their own. They then had to find a place to store it as well. Both of these limitations made it challenging for more investors to consider fine wine’s prospective role in their portfolio.

Further, there were only a few ways to sell bottles quickly and easily. VinoVest solves each of these problems by creating a simple marketplace for buying and selling wine. Better still, VinoVest even holds onto the bottles for you, shipping them to you whenever you want to move them into your personal collection.

All this is a boon to investors looking to diversify their portfolios. Fine wine is an excellent store of value, particularly during a recession, with extremely low volatility.

For example, in Q1 2020, the S&P 500 fell more than 23%. In contrast, the Liv-Ex Fine Wine 1000, an index that measures the performance of the 1,000 most traded fine wines, was down merely 4%. This is not a fluke — the Liv-ex Fine Wine 1000 was similarly resilient during the GFC.

Fine wine has also out-performed major stock indices and other common alternative investments over the past 30 years.

You can sign up for Vinovest here.

Alternative Investments For The Future

The appetite for alternative investments will likely continue to grow in the years ahead. With the stock market close to record-highs, money is naturally overflowing to alternative investment.

Some investors are looking for laggard investments. While other investors are looking to hedge against stock market downside and volatility. Meanwhile, all investors are looking for absolute returns.

A note from me: Thanks again to FarmTogether, Masterworks, and Vinovest for their sponsorship. I told Artem, the Founder & CEO of FarmTogether that we’d get some sushi if we get to herd immunity. He lives in my neighborhood in SF and we were going to meet up right before everything shut down.

I’m looking to grow my alternative investment exposure to 20% from 15% over the next 12 months. It’s hard for me to put extra money to work in the stock market and bond market at these levels.

Sure, I’ll keep maxing out my Solo 401(k), SEP-IRA and my kids 529 plans and Roth IRAs mostly in stocks like usual. However, investing beyond the contribution limits is hard unless there is a 10%+ correction in various stocks.

Although I’m still bullish on stocks, there is so much euphoria in the stock market now. I’d rather invest in laggard asset classes or asset classes that aren’t getting as much attention, yet.

[ad_2]