How good was 2019 for the precious metals market? It definitely brought quite some excitement to the arena. In today’s article, you’ll learn more about the most important gold price drivers in 2019. This analysis will help you better understand the gold market, and draw the right investment conclusions for 2020.

Another year has passed! And we gave another accurate prediction. In the January 2019 edition of the Market Overview, we wrote:

All these factors make us to believe that 2019 fundamental outlook for the gold market is better than one year ago (…) Hence, we should see better price performance next year.

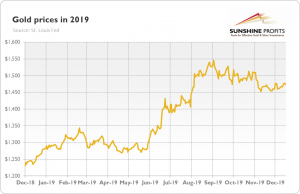

Fast forward to January 2020 – we line now in the twenties! – it turned out that we were right again. Just look at the chart below, which paints the gold prices over the last year. The yellow metal entered 2019 quoted at $1279, and finished the year at $1474 (as of December 18).

Chart 1: Gold prices (London P.M Fix, in $) from December 2018 to December 2019.

So, gold rose more than 15 percent last year (as of December 20), which was perfectly in line with my fundamental expectations! I did not expect a massive rally (“we are not saying that bullion will start to rally. What we are saying is that fundamental factors should become (…) more friendly toward gold”). And indeed, a 15-percent jump is impressive, but the yellow metal did not enter the full-blown bull market. Nevertheless, 2019 was definitely better for gold prices than 2018, when the yellow metal dropped slightly.